UPL share price (NSE:UPL) now is ₹ 588.5 , and in details the Upl share price target 2025 and more has been discussed, lets deep dive into the world of Future investment plans.

About UPL

United Phosphorus Limited (UPL), is an Indian multinational company that produces and sells agrochemicals, industrial chemicals, chemical intermediates, specialty chemicals, and pesticides. It is India’s largest largest producer of agrochemicals & world’s top five post-patent producer of agrochemical manufacturers. OpenAg is an initiative by UPL to enhance the open agriculture network feeding sustainable growth for all.

UPL present in 130+ countries and access to 90% of the world’s food basket, also have disbursed around $5 billion worth of total crop solutions to the farming community worldwide. It invest significantly in R&D and innovation for change, with 27 formulation labs, 48 manufacturing plants worldwide and a portfolio of 12,400+ registrations. In three segments UPL operates its business like Crop protection, Seeds business, Non-Agro.

- Market Cap ₹ 44,083 Cr

- Current Price ₹ 587

- High / Low ₹ 788/ 528

- Stock P/E 25.8

- Book Value ₹ 385

- Dividend Yield 70%

- ROCE 14.3%

- ROE 13.4%

- Face Value ₹ 2.00

UPL share price Target 2024

By the End of 2024, UPL share price target is ₹882 to ₹920. This year it may cross may touch the new 52 weeks high. If the bullish rally starts by the 1st quarter of 2024 then By the next resistant price will be ₹633.5 and second resistant will be ₹698. By the June and July end of 2024 market may take a side wise path and by the starting of last quarter of 2024, bulls may come back which will lead the stock to a new high up to ₹772 to ₹820.

UPL share price Target 2025

UPL Limited share price is after giving breakout in daily candle stock pattern, it now bouncing back from its support price of ₹530. If the rally doesn’t sustains then it may fall to the next support of ₹477. Fundamentally UPL is strong and as its involved with news strategic agricultural activities’, in future the stock has capacity to hit upper circuit.

If the price comes to a marginal value like 510 to 490, it will be good time to buy at low, or else just for the next support. Based on these if I target the share price prediction of UPL by 2025 then it may reach the price around ₹1039-1050 , which is almost 200% return within 48 months of span.

UPL share price Target 2026 to 2030

Based on the technical analysis, a share price of UPL by 2030 will be crossing ₹1500. Based on technical analysis the data are provided below in the table.

| Share price Prediction of UPL limited from 2026 to 2030 | ||

| Prediction | Max Price | Min Price |

| 2026 | ₹ 1,083.00 | ₹ 935.00 |

| 2027 | ₹ 911.00 | ₹ 1,320.00 |

| 2028 | ₹ 1,250.00 | ₹ 1,450.00 |

| 2029 | ₹ 1,188.00 | ₹ 1,350.00 |

| 2030 | ₹ 1,350.00 | ₹ 1,500.00 |

Supporting Data for More Clarity about UPL Limited Share

Expert’s Opinion about UPL’s future Performance

UPL is a Strong Performer, Under radar Category by Trendlyne.com, “based on 21 reports from 7 analysts offering long term price targets for UPL Ltd.. UPL Ltd. has an average target of 615.00. The consensus estimate represents an upside of 4.85% from the last price of 586.55.”

According to ICICI Securities, UPL has a hold rating with a target price of Rs 562 for 2023

By Simplywall.st Future criteria checks, “UPL getting 3/6, and stated that UPL is forecast to grow earnings and revenue by 35.6% and 7.2% per annum respectively. EPS is expected to grow by 22.1% per annum. Return on equity is forecast to be 12.7% in 3 years.”

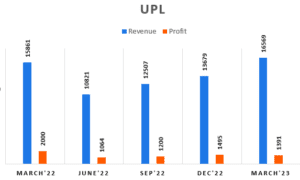

The profit was little down by 104 crores from last quarter but the revenue increased from by 2890 crores, hopefully the target price it can meet at the Buying side.

Want to know a High performing stock for a handsome return in short span of Investment?

UPL limited share Dividend History

UPL Ltd has a good dividend history based on last 5 years data:

- 2022-2023: Rs.10.00, 500%

- 2021-2022: Rs.10.00, 500%

- 2020-2021: Rs.10.00, 500%

- 2019-2020: Rs.6.00, 300%

- 2018-2019: Rs.8.00, 400%

Share holding Pattern of UPL

Promoter’s share are gradually increasing Year by Year, which is a good sign of having confidence on the pretty Growth of the Company.

| Dec-20 | Dec-21 | Dec-22 | Sep-23 | |

| Promoters | 27.85% | 28.24% | 30.74% | 32.34% |

| Foreign Institutional Investors (FIIs) | 35.36% | 34.27% | 37.18% | 33.57% |

| Domestic Institutional investors (DIIs) | 16.33% | 18.65% | 16.19% | 17.27% |

| Public | 20.15% | 18.84% | 15.87% | 16.81% |

Revenue & Profit Statement of UPL from March 2022

| March’22 | June’22 | Sep’22 | Dec’22 | March’23 | |

| Revenue | 15861 | 10821 | 12507 | 13679 | 16569 |

| Profit | 2000 | 1064 | 1200 | 1495 | 1391 |

The data’s above are sourced from Screener.in, you can refer for more detail study

Frequently Asked Questions (FAQ)

Why UPL share price is falling?

Upl share is giving a correction in its price, so the fall is expected to be normal and creating an opportunity to invest at a low price.

What is the UPL share price target 2025?

UPL share price target for 2025 is around ₹1039 to ₹1050

What is the price target of UPL in 2024?

UPL share price target for 2025 is around ₹772 to ₹820.

What is OpenAg by UPL?

OpenAg is an initiative by UPL to enhance the open agriculture network feeding sustainable growth for all.

Conclusion: Should you invest in UPL for long term?

Its a complete personal opinion, based on facts and last performances, UPL is long term candidate for a bullish stock campaign. Any one can expect return of 200-300% growth within 5 to 7 years excluding any unfair circumstances. The management has a progressive thought towards the growth, addition to this India is going invest a lot in agricultural sector for food efficacy. Here UPL plays an important role, So its investible.

N.B: However, investing is subjected to market risk. we are only putting our best effort as a torch bearer in the investment learning world. Before investing you should do your own research, gain knowledge then invest, stockmarketviews.in is not liable to any personal monetary affairs.