Shyam Metalics and Energy Limited (NSE: SHYAMMETL) is a prominent integrated metal-producing company in India, major presence is in West Bengal and Odisha. Lets discuss the shyam metalics share price target 2025 and onwrds, the company which has expertise in Long steel Products and Ferro alloys.

SHYMMETL is profitable with a good track record of positive EBIDTA since 2005.Based on CRISIL report as of 2023, Shyam Metalics is forth largest player in the Sponge Iron capacity in India as well as Industry leader in pellet production capacity in West bengal and Odisha.

Current (25th April 2024 ) share price of SHYMMETL is Rs 637.10 with bullish candlestick pattern. In contrast to the share price last year april 2023 (Rs 301.5), the stock has given a more than 100 % Return.

Shyam Metalics share price target 2024

Shyam Metalics share price target for 2024 is Rs 845, which is 25% upside from the current price. The price may stay between Rs 530 to Rs 850. Technically, in the candle stick chart, the stock price has recently bounced back from near support of Rs 515.20.

Shyam Metalics share price target 2025

The share price target for 2025 is Rs 1120, a target of 32.5 percent return from last year,2024 target price. A monthly projected share price for 2025 is shared below.

| MONTHS | TARGET-1 (Rs) | TARGET-2 (Rs) |

| JAN | 768 | 798 |

| FEB | 798 | 845 |

| MARCH | 847 | 913 |

| APRIL | 915 | 985 |

| MAY | 986 | 1056 |

| JUNE | 1056 | 1137 |

| JULY | 1135 | 1195 |

| AUG | 1195 | 1120 |

| SEPT | 1120 | 1042 |

| OCT | 1042 | 975 |

| NOV | 981 | 1042 |

| DEC | 1042 | 1116 |

Demand for Iron / steel and and Metals based on the research data

- The Ministry of Steel has set a vision for the Indian steel industry to achieve a crude steel capacity of 300 MT, a production of 255 MT, and a per capita steel consumption of 160 Kgs by 2030. The country’s steel demand will more than double in the next seven years, from 120 MT last year to 250 MT, Acoording to Govt. of India.

- Steel demand is projected to rise 30% by 2050. So, Shyam metalic’s expertise is going to play a lead role in future for metal extraction.

Shyam Metalics share price target 2026

Shyam Metalics & Energy limited share price target for 2026 is Rs 1375, setting a target upto 25 % Upside from the year 2025.

| MONTHS | TARGET-1 (Rs) | TARGET-2 (Rs) |

| JAN | 1116 | 1202 |

| FEB | 1208 | 1275 |

| MARCH | 1269 | 1235 |

| APRIL | 1231 | 1198 |

| MAY | 1198 | 1246 |

| JUNE | 1248 | 1315 |

| JULY | 1315 | 1386 |

| AUG | 1386 | 1309 |

| SEPT | 1309 | 1237 |

| OCT | 1237 | 1289 |

| NOV | 1289 | 1398 |

| DEC | 1382 | 1325 |

Shyam Metalics share price target 2027

The share price target of Shyam metalics for 2027 is Rs 1628, which is a target of percent last year. This year SHYAMMETL may under go a tragic correction till the next support price of Rs 1380 and it will bounce back till 1649.

| MONTHS | TARGET-1 (Rs) | TARGET-2 (Rs) |

| JAN | 1325 | 1401 |

| FEB | 1402 | 1488 |

| MARCH | 1495 | 1576 |

| APRIL | 1576 | 1690 |

| MAY | 1690 | 1766 |

| JUNE | 1765 | 1652 |

| JULY | 1652 | 1588 |

| AUG | 1584 | 1452 |

| SEPT | 1450 | 1380 |

| OCT | 1385 | 1450 |

| NOV | 1450 | 1508 |

| DEC | 1520 | 1649 |

Shyam Metalics share price target 2028,2029 & 2030

In 2028 this stock is going to hit a new 52 weeks high of price Rs 2253. For 2028, the share price target of Shyam metalics is Rs 2245.

Similarly, shyam metalics share price target 2029 is Rs 1945, a depriciation in price prediction than last year due to steep correction in price may happen this year.

Shyam metalics share price of target 2030 is Rs 2596, Which is 286 Percent return from current price (Rs 673).

| MONTHS | TARGET-1 (Rs) | TARGET-2 (Rs) |

| JAN-2028 | 1650 | 1720 |

| APR-2028 | 1523 | 1680 |

| JUL-2028 | 1788 | 1848 |

| OCT-2028 | 2052 | 2253 |

| JAN-2029 | 2125 | 2195 |

| APR-2029 | 2058 | 2112 |

| JUL-2029 | 1945 | 1847 |

| OCT-2029 | 1945 | 1836 |

| JAN-2030 | 1830 | 1985 |

| APR-2030 | 1980 | 2124 |

| JUL-2030 | 2342 | 2456 |

| OCT-2030 | 2456 | 2598 |

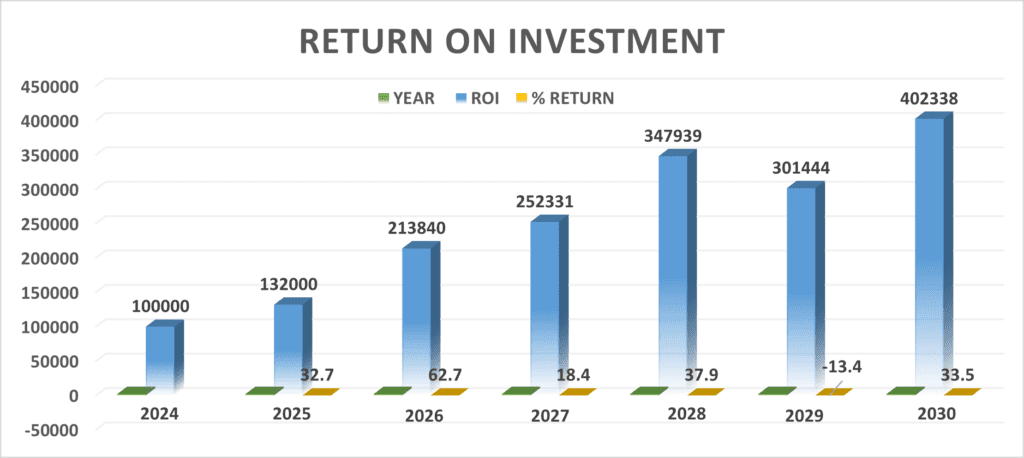

How Much Return could be expected If Invested in SHYAM METALICS

If you are investing a INR 1,00,000 from now then by 2023 you could expect an multifold return of INR 4,02,338 within 6 years of duration. This kind of return is defintely better than any other Investement portfolio, whether Fixed Deposit or Mutual Fund or any Bonds, if propeprly managed.

Look at the Return On Investment prediction Chart

Shoud You Invest in SHYAM METALICS?

The choice is defintely personal and depend on your risk apetite. As Shyam Metalics has a very good presence over West Bengal, Odisha and expanding to other states, it has a potential to reach a greart hieght in share price. The company is in a asset based industry, if any way company goes down, it can be taken by any other competitors easily.

So, conslusion is so stedy and better return you can invest in Shyem Metalics & Energy limited.