Reliance Ind. Financial Services Demerger: A Potential Opportunity or a Risky Bet?

Reliance Industries has announced plans to spin off its financial services business into a separate entity called Jio Financial Services (JFS). The demerger will be effective on July 20, 2023 and JFS will get listed on the stock exchanges in a few months.

Investors are excited about the demerger because they see JFS as a potential growth mover for Reliance. At this particular moment, financial services contribute a relatively small amount to Reliance’s revenue, but there is potential for this business to grow significantly in the coming future.

The demerger will be carried out on a 1:1 basis, which means, for every share of RIL that you hold on July 20, you will receive one share of JFS. This is a very lucrative proposition for investors, as it gives them the opportunity to get onto the step of potential growth at a relatively low cost.

Here are some key facts to keep in mind about the demerger:

• The demerger will take effect on July 20, 2023.

• JFS will be listed on the stock exchanges in a few months.

• If you hold 1 share of RIL in your account on July 20, you will be entitled to 1 share.

• The demerger is a 1:1 demerger ratio.

• JFS has the potential to be a significant growth driver for Reliance.

By the way, why RIL is doing this, surprise, hmm?

Well, we can’t tell you for sure, but there are some arguments hovering.

Investors’ views on Reliance’s Financial Services Demerger:

Some investors are excited about the demerger because they see JFS as a potential growth driver. They believe that the financial services business has the potential to grow significantly in the future, and they are eager to get in on the ground floor. Other investors are more cautious about the demerger. They worry that the financial services business is still relatively small, and they are not sure if it will be able to achieve the growth that some investors are expecting..

Only time will tell what impact the demerger will have on Reliance Industries and its shareholders. However, the demerger is a significant event and investors should keep an eye on it.

Why Reliance Ind. demerger happening: Two possible objectives

The plan to split its financial services business into a different entity called Jio Financial Services has received mixed reactions. Some analysts believe this is a cynical attempt to boost the share price, while others believe it is a more strategic move to reduce leverage and focus on core businesses.

- Cynical outlook

One possible motive for the demerger is to boost the share price of Reliance Industries. The stock price has been relatively flat in recent years, and the demerger could offer investors an opportunity to buy a new and potentially growing business. This could lead to a short-term rise in the share price as investors rush to buy shares in Jio Financial Services. - However, this approach is somewhat cynical. Reliance Industries is a well-established company with a long history of success. It is unlikely that they will need to resort to cheap tricks to raise the share price.

- The more strategic view

- A more plausible motive for the demerger is to reduce leverage. Financial services businesses typically have high levels of debt. By de merging the financial services business, Reliance Industries could reduce its overall debt burden and improve its financial flexibility. This would make the company more attractive to investors and could help to boost the stock price in the long run.

In addition, the demerger could allow Reliance Industries to focus on its core businesses, such as energy and retail. This would allow the company to allocate its resources more efficiently and achieve greater growth.

The true motive for the demerger of Reliance Industries’ financial services business is unknown. However, the two motives mentioned above are both plausible. Only time will tell which motive is correct. In addition to the above, here are some other possible motives for the demerger:

- To comply with regulatory requirements.

- To attract strategic investors.

- To create a more efficient and agile business.

- Ultimately, the demerger is a complex decision with multiple potential motives. It is likely that a combination of factors played a role in the decision.

By separating and cataloging JFS, it sort of eliminates this problem. Also, Reliance could attract a whole new set of investors in this business. Large institutional players will probably want to ride India’s fintech wave, but may not want a share of the oil and gas or retail sector. They will also not have to worry about ESG factors. It will be similar to how Reliance has induced Meta and Google to invest in Jio Platforms by promising a clean chunk of Digital India.

Will Jio Financial Services be successful?

There are a number of factors that could contribute to JFS’s victory.

First of all, the company has built a strong management team led by KV Kamath, a pioneer of the banking industry whose expert team will lead JFS into the future.

Secondly, JFS has a large and captive customer base. The company will have access to the 400 million users of Jio telecom, the thousands of Reliance Retail stores, and the 2 million merchants onboarded on the Jio Mart grocery platform. This gives JFS a significant advantage over its competitors, whose level of reach is far away.

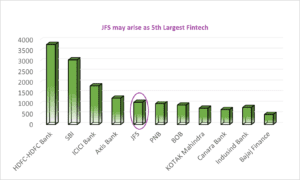

Third, Reliance is basically going to offload a bunch of its own shares to its financial services unit. This means that JFS will own around 6% of RIL and based on that value, its net worth will be over ₹1 lakh crore. Similarly, it has probably become India’s 5th largest financial services company in terms of net worth.

However, there are also some challenges that JFS will need to overcome.

The fintech space is highly competitive, and JFS will need to differentiate itself from its rivals by building a strong brand reputation. Overall, JFS has the potential to be a successful company to go both old players and new entrants like G-Pay and Amazon Pay etc.

Also Read: Jio Financial Services share price Target 2025

Should You Invest In RIL to get JFS?

Yeah, This is completely a personal decision based on your instinct and trust on Reliance brand. Reliance industries has already shared a appreciable growth from its inception with strong impact on Indian Economy. Hopefully same pace and trust will be guiding light for new investors and retailers.

Finally , we are at the tail end, whether you invest or not, but retain your lovely eyes on us and keep reading our blog.

Probably the positive side of the JFS will be visible after its launch as JFS will be run by Business giants.