Hi Dear Reader,

Options Trading : Its a very greedy and heavy word after all for every traders. Trading options is like sitting on a roller coaster don’t have much idea where its heading on. According to a Research by Securities and Exchange Board of India (SEBI) 89% of the individual traders (i.e. 9 out of 10 individual traders) in Equity Future & Options segment incurred losses, with an average loss of Rs. 1.1 lakh during FY22, whereas, 90% of the active traders incurred average losses of Rs. 1.25 lakh during the same period. However, anybody can develop the skills and aware of mistakes to avoid for a profitable trader with options trading Strategies.

Options Trading Strategies: Basics

Options trading is only a instrument available only in F&O active stocks and Indexes. In real case option trading is a technical skill based instrument which don’t much depend 0n the Fundamental Analysis. So to be a pro trader you must have idea of Technical Skills.

N.B: We are going to discuss here all about the Options Buying Skills, not on Options Selling, That for an another chapter.

Call & Put options

A Call option gives the holder the right to buy an underlying asset at a specified price, known as the strike price, before the option’s expiration. Most Simply, If Your analysis says price will move Up more buying will happen, then Bye a call option of above the Current strike price. If the Candle go up, then Call price value will increase and you will be profitable.

On the other hand, Put options give the holder the right to sell an underlying asset at a predetermined strike price before the option’s expiration. Simply, if you predict a downfall in the price of the Index, then buy a Put option which value will increase with decrease in Index value.

Options Trading Strategies: What Excites The Most?

When a stocks move with a momentum then that time you just check the Options chain price, it sky rockets and moves so fast that gives huge return on your Investments. In this making 10-30% in a single trade is very simple and more than that is also possible. Then why to wait for a year long time for the same amount of return from Investing. Those peak graphs of Call/Put excites most to the traders and make them to try their Luck/Skill.

Options Trading Strategies: Mistakes to avoid for a Profitable Trader:

To be a smart and profitable trader you must need to learn and practice in real market with some amount of affordable money. In the first phase of Trading options people mostly loses money, which teaches million dollar lessons. However with the experience, some very important mistakes you aware of so that you should not try to repeat.

Mistakes that you shouldn’t do during Options Buying / Create Your self as an Expert

-

The FOMO fact:-The fear of missing opportunity:

Every time you look market, You will find an Missed opportunity, just like you could have earned but not able to grab! Its a fact it happens, But always go with a process and and try to capture momentum rather than trading every time.

-

Which market you should Avoid:

Its better to save money than loosing in a slow and sidewise market. Because in sidewise market only option seller makes money with the help of beta decay, option buyer make nothing rather overtrading takes all the money.

-

How Many no of Trading are called

Surprisingly there is no certain definition, But I will suggest never go beyond 1o or 12 Maximum per day. Why we do overtrading: Simple reason is not able to control psychology, either you need more profit or You are trying to recover the loses. But believe me , it not happens, of only 10-15% chance you have to recover, next you will try to take big risk and trade. But at the end of the day You have to book only loses.

-

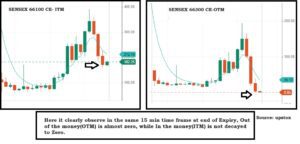

Try to avoid Buying Deep Out of the Money Call/Put:

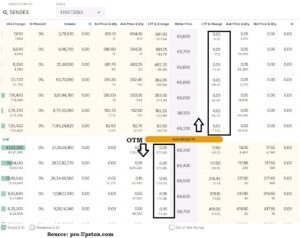

Deep out of the Money(OTM) are more volatile and Beta Decay happens sharply, means OTM price falls faster than At The Money (ATM) or In The Money (ITM). The real scenario is OTM call/Put volatility is so fast, that catching it is difficult. If it starts falling also, you mayn’t able to book the profit by on time and loose your profit as well as capital, try to avoid this. Mostly New Retail traders(who trade with small amounts) lose their maximum cash in this trap on expiry day and every . In my suggestion manage your risk and only buy ATM or ITM call/put, because their value mostly not becomes zero end of Expiry day, at least some capital will remain, not like OTM, which definitely becomes zero. Just go through the figure below.

-

Don’t Be An Emotional Fool, Only Take calculative Risk:

In Trading community we called it as Risk Management, Create A good Habit of trading only 35% -50% maximum of your CAPITAL remaining in Demat account. So that, losses can be recovered latter. Otherwise with your greedy character/ getting angry on market, nothing happens rather, all your Capital washes away.

-

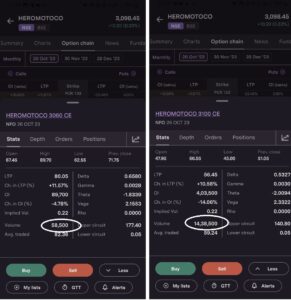

Trade with High Volume Strike price:

Sometimes Buying and selling dont happen smoothly due to less volume in that strike price. Basically this type of problem faced in Future and Options Activated Stocks. So before you take trade in Stock options, check the volume of the Strike price. The best thing is always try trade Nifty 50 /Nifty 100 F&O stocks or Bank nifty/ High volume NBFCs. Similarly buy the the ATM Call/ Put options to get benefit of volatility.

-

Focus, Patient and Flexibility are the Keys:

To be profitable some times you have to wait for a long time, but at the same time you should be psychologically active to grab the opportunity of momentum. To be smart and Profitable trader, first you have to learn about Technical analysis of Candle stick,

- Fun fact: More no of trade you do, you make profit or not, brokerage firms are definitely making money from you. By the SEBI data, on an average loss maker lose an additional 28% as transaction cost. While, Profit makers share between 15 % to 50 % as transaction cost. Just Think who is making money….Is it Really You??

Dear Reader, Still its not enough to explain all the Strategies and mistakes at one go. It comes from experience at real market and reading more no of articles based on the Options trading.

Trading is a game of 80% Psychology and 20% Analysis. You need to be more active To practice Trading You need to open Demat Account first and then Start a real learning with a low Budget for a clear hand set and mind set.

2 thoughts on “Options Trading Strategies: Mistakes to avoid as a Trader”

Comments are closed.