Options Trading Secrets For Beginners

Options trading can be a lucrative endeavor for those who have a basic understanding of the Stock market, technical analysis of charts and its strategies. If you are looking to multiply your investment portfolio and potentially increase your earnings, learning about options trading is a great place to start. In this article, we will explore the basics of options trading and provide you with some valuable insights to help you get started on your journey to financial success.

Understanding Options Trading

What are the options?

Wants to deep dive into the Options Trading Secrets for Beginners, let’s understand some must-know basics.

Options are financial derivatives that give traders the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specified period of (time, maybe weekly or monthly). These underlying assets could be stocks like Reliance, Tata Motors etc, Indexes like Nifty 50, Finnifty and Bank Nifty, Sensex, , commodities like Gold, silver, or even currencies like dollars, Rupees, etc. Is it sound simple?

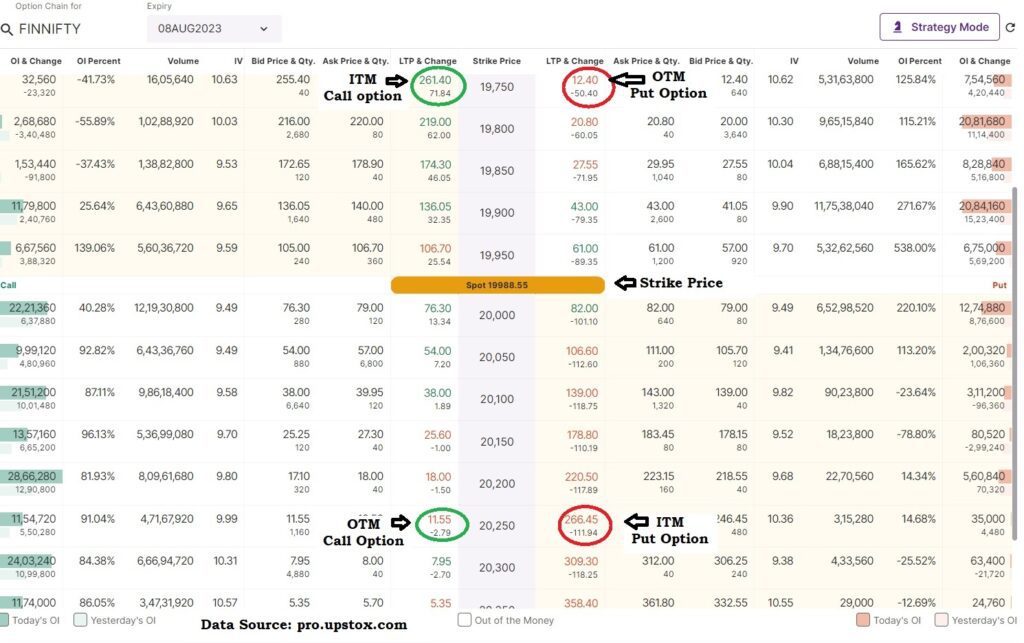

Let’s take example of the Finnifty options index to get some ideas!

Call & Put options

A Call option gives the holder the right to buy an underlying asset at a specified price, known as the strike price, before the option’s expiration. Most Simply, If Your analysis says the price will move up more buying will happen, then Bye a call option of above the Current strike price. If the Candle goes up, then the Call price value will increase and you will be profitable.

On the other hand, Put options give the holder the right to sell an underlying asset at a predetermined strike price before the option’s expiration. Simply, if you predict a downfall in the price of the Index, then buy a Put option whose value will increase with a decrease in Index value.

Important Terminologies in Option Trading

Strike price

The strike price is when the underlying asset can be bought or sold when exercising the option. It is an essential component of option contracts and plays a significant role in determining the profitability of a trade.

Premium

The premium is the price paid by the buyer to the seller for acquiring the option. It represents the cost of the option and is influenced by factors such as the volatility of the underlying asset, time to expiration, and market conditions.

Expiration date

Every option has an expiration date, which is the last day on which the option can be exercised. For Example, Bank Nifty and Nifty 50 Expire weekly every Thursday likewise Finnifty expires on every Tuesday. On the expiry day as premium of the value was decreased so the change in intrinsic value changes very significantly making a most volatile day for option trading.

In-the-money, at-the-money, and out-of-the-money

An option is considered In-the-money (ITM )when the current price of the underlying asset is higher (for call options) or lower (for put options) than the strike price. At-the-money (ATM) refers to the scenario where the current price is equal or near by equal to the strike price. Out-of-the-money (OTM) options have a strike price that is not favorable or very high compared to the current market price.

Options Trading Secrets for Beginners:1st Strategies

Options Buying

Considering the above Fin nifty chart, If Your analysis says the price will move Up more buying will happen, then Bye a call option of above the Current strike price. If the Candle go up, then Call price value will increase and you will be profitable. Let’s here you bought one lot (40 shares) of Finnifty Call option of 20,000/- strike price at 76.30/- and you sell it at suppose 96.30/-. Then your profit is

1 lot buying price= 40×76.30= 3052 /- and you sold that at 93.6.x 40=3852/-

Your profit is=3852-3052= 800 rupees per lot.

If you buy 10 lot at cost of 30520, then you may get return of 8000/- which is almost 26% return on investment (ROI). If you got two or three opportunities per day like this then you can get handsome ROI.

On the other hand, put options give the holder the right to sell an underlying asset at a predetermined strike price before the option’s expiration. Simply, if you predict a downfall in the price of the Index, then buy a PUT option which value will increase with decrease in Index value.

Lets here you bought 10 lot (400 shares) of Finnifty Put option of 19,900/- strike price (OTM) at 43/- and you sell it at suppose 53/-.

Then your profit is

1 lot buying price= 400×43= 17200 /- and you selling cost: 53x 400=21200/-

Your profit => 21200-17200= 4000 rupees per 10 lot.

Just By investing within 5000 rupees, anyone can start option trading.

On the other hand, put options give the holder the right to sell an underlying asset at a predetermined strike price before the option’s expiration. Traders often use put options when they predict a decrease in the price of the Index.

Advance strategies

- Covered calls

A covered call strategy involves selling call options on a stock that the trader already owns. This strategy allows the trader to generate income through the premiums received while still benefiting from any potential upside in the stock’s price.

- Protective puts

Protective puts serve as a form of insurance. By purchasing put options on stocks that the trader already owns, they can limit their downside risk in case the stock price declines.

- Straddles

Straddles involve buying both a call option and a put option with the same strike price and expiration date. This strategy is used when the trader anticipates a significant move in the underlying asset’s price, regardless of the direction. It can be profitable if the price moves sufficiently in either direction.

- Spreads

Option spreads involve simultaneously buying and selling options with different strike prices. There are various types of spreads, such as debit spreads and credit spreads, each with its own risk and reward profile. Spreads can be used to hedge positions or generate income with limited risk.

All the advanced strategies require very neat and clean explanations for better understanding, we will cover it in later articles.

Risk Management in Option Trading

Like Both sides of the Coin, Profit, and Loss are two facts, loss-making probability is the maximum in option buying. While option trading can offer substantial returns, it is essential to manage risk effectively. Here are a few crucial risk management practices to consider:

- Set clear profit targets and stop-loss orders to ensure you cut your losses and secure your gains at the perfect time. Its a trade of focus and agility, you have to always be ready to book the loss or Profit. Remember Unless and until you book the profit to your account, displayed profits are just numbers for you.

- Diversify your portfolio by trading options with different underlying assets. Only Use 25% of your capital for Options trading. never go beyond that because it may look like lucrative profits, but when loss happens also in a similar fashion it takes a huge amount. If 75% capital you still have with you then still you are in the game to recover the losses.

- Understand and evaluate the implied volatility of options before trading them. Be very careful on Expiry day, if you carefully and technically set the trade then you can hit the Jackpot of huge returns. Other hand, if you lose, it also digs deep into your account so be careful and only use 10-15% of your capital that day.

- Regularly monitor and adjust your option positions based on market trends and changes in the underlying asset’s price.

- Always start learning with an amount of money that will not hamper your pocket. Once you master the real game in the market then come with some big investments. Remember, the Market will take some penny to make you aware of the real trade pattern and trade psychology, hence never put your savings into the stock market, it’s too risky for a new bee.

Conclusion

Finally, if you have arrived here, then you are the most deserving person to master the strategies. Your journey to learn options trading can be an exciting and rewarding endeavor. Always practice prudent risk management and continually educate yourself to stay ahead in this dynamic field. Start learning options trading today and unlock the potential to make money in the markets.

2 thoughts on “Options Trading Secrets for Beginners: Must Read”

Comments are closed.