There is a new disruption is going to happen in the financial sector with the entry of a New Player, trained by Financial Giants. Here we are talking about Jio Financial Services, which recently went public and listed in NSE & BSE on 21st Aug 2023 with the nickname of JIOFIN . This article will help you to get a crystal clear idea about the company fundamentals, business model, performance, and SWOT Analysis, meanwhile, you can predict the Jio financial services share price target 2025 and so on.

Jio Financial Services Business model

Hold on! First thing First…

Once entering the Indian Financial Market, Just have eyes on statements by Finance Shark.

The market is large enough. .. Even [after] being present in 4‚000 cities [with] assets close to Rs 3 lakh crore‚ we still have less than 2 percent [share in] India’s credit market.

Sanjiv Bajaj

CMD

Bajaj Finserv

“Mukesh Ambani’s Jio Financial Services’s entry into the financial services sector is a “good thing”, entry into the sector would keep its competition on edge” by Uday Kotak

Jio Financial Service (JIOFIN) is company that aims to digitally deliver a range of financial products and services to the people of India, especially the unserved and underserved segments. JIOFIN was formed by the merger of Reliance Industries and Reliance Financial Services in 2023. JIOFIN is a systemically important non-deposit-taking NBFC registered with the Reserve Bank of India. It operates its financial business through its subsidiaries and joint ventures, namely Jio Finance Limited, Jio Insurance Broking Limited, Jio Payment Solutions Limited, and Jio Payments Bank Limited.

What Jio Financial Services do to run the business?

- JIOFIN offers various financial products and services, such as lending, banking, insurance, and payments.

- JFS is backed by the parent company in Reliance Industries Limited (RIL), which itself having a customer base of over 400 million across its telecom, retail, and digital platforms. RIL has also invested heavily in building a robust digital infrastructure and ecosystem in India, like Jio Platforms, JioMart, JioSaavn, JioCinema, JioTV, and more.

- Along with it also partnered with global giants such as Google, Facebook, Microsoft, Qualcomm, Intel, and others to enhance its digital capabilities and reach.

- Meanwhile, JIOFIN has also forged strategic partnerships with BlackRock, one of the world’s largest asset management companies, to enter the mutual fund industry in India. Both have pledged an investment of $150 million each to launch low-cost passive funds in India.

- It has partnered with SBI Cards to launch co-branded credit cards for its customers.

- JFS applied for life and non-life insurance licenses to enter the insurance sector in India.

SWOT Analysis of JIOFIN

Standalone Income Statement of Jio Financial Services

| Annual | Mar 2023 | Mar 2022 | Mar 2021 | Mar 2020 | Mar 2019 |

| Sales | 41 | 148 | 295 | 349 | -105 |

| Other Income | 3 | 35 | 15 | 0 | 0 |

| Total Income | 44 | 184 | 310 | 349 | -104 |

| Total Expenditure | -4 | 7 | 82 | 27 | 16 |

| EBIT | 49 | 176 | 228 | 321 | -120 |

| Interest | 0 | 0 | 110 | 127 | 247 |

| Tax | 18 | 8 | -5 | -36 | 32 |

| Net Profit | 31 | 168 | 123 | 229 | -401 |

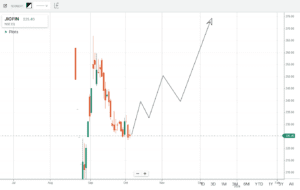

Jio Financial Services Share price

Jio Financial Services share price target 2023

| Jio Financial Service Share Price Target 2023 | ||

| Prediction | Max Price | Min Price |

| Oct-23 | ₹ 224.00 | ₹ 212.00 |

| Nov-23 | ₹ 220.00 | ₹ 204.00 |

| Dec-24 | ₹204.00 | ₹ 190.00 |

| Dec-24 | ₹ 218.00 | ₹ 208.00 |

Jio Financial Services share price target 2024

Once the fresh buyers come, the stock JIOFIN may rise again from the deep correction and the year 2024 may be a skyrocketing year from the it may start from the bottom line to a new all-time high may be like predicted list as above table. However the price here predicted is based on certain parameters that may vary from statistics, it may go beyond the list or below. But yes, some disruption is definitely going to come in the Banking sector as the style of working of Mr. Ambani is way far from others which will make JFS a market leader in future.

| Jio Financial Service Share Price Target 2024 | ||

| Prediction | Max Price | Min Price |

| Jan-24 | ₹ 230.00 | ₹ 218.00 |

| May-24 | ₹ 275.00 | ₹ 258.00 |

| Sep-24 | ₹ 310.00 | ₹ 285.72 |

| Dec-24 | ₹ 330.01 | ₹ 315.70 |

Jio Financial Services share price target 2025

| Jio Financial Service Share Price Target 2025 | ||

| Prediction | Max Price | Min Price |

| Jan-25 | ₹ 330.00 | ₹ 318.00 |

| May-25 | ₹ 352.00 | ₹ 324.00 |

| Sep-25 | ₹ 375.00 | ₹ 342.00 |

| Dec-25 | ₹ 390.00 | ₹ 365.00 |

Jio Financial Services share price target 2026 to 2030

| Jio Financial Service Share Price Target 2026 to 2030 | ||

| Prediction | Max Price | Min Price |

| 2026 | ₹ 380.00 | ₹ 355.00 |

| 2027 | ₹ 485.00 | ₹ 420.00 |

| 2028 | ₹ 570.00 | ₹ 490.00 |

| 2029 | ₹ 780.00 | ₹ 650.00 |

| 2030 | ₹ 1090.00 | ₹ 898.00 |

Conclusion:

The share price of Jio Financial Services (JIOFIN) will undergo a correction, after that it will start moving up & in the long run, it could be a multi-bagger stock. Its price may touch ₹245-250 by the end of 2023, while by the end of 2024, it could have jumped to ₹315-₹325. In the year of 2025 it may skyrocket its journey till a target share price of ₹390 and by the end of the year 2030 JIOFIN’s share price could have reached to ₹1000 mark. But it will be not a miracle if the share price reaches more than our prediction, because this company has a clear vision and strong team to deal with.

N.B: However, investing is subjected to market risk. we are only putting our best effort as a torch bearer in the investment learning world. Before investing you can do your own research, gain knowledge then invest.

Frequently Asked Questions(FAQ)

Is Jio Financial Services a good stock to invest in?

Ans: In my Point of View, of course, JIOFIN has miles to go, it’s a long-run asset. Financial Giants are the company’s core members, Ambani family supervision, what else is needed? It can show a stopper in the Dalal Street.

What is the Market Capital of Jio Financial Service?

Ans:1.4 trillion INR

Why Jio Financial Services (JIOFIN) share is falling now?

Ans: It’s only the profit booking happening by Investors, it’s natural. After the selling is over, at a reasonable price range, fresh buyers will enter and again the the Roller Coaster journey starts. Just Rewind the lines of Warren Buffet” Be fearful, when the market is greedy and Be greedy when the market is fearful”

4 thoughts on “Jio Financial Services share price Target 2025”

Comments are closed.