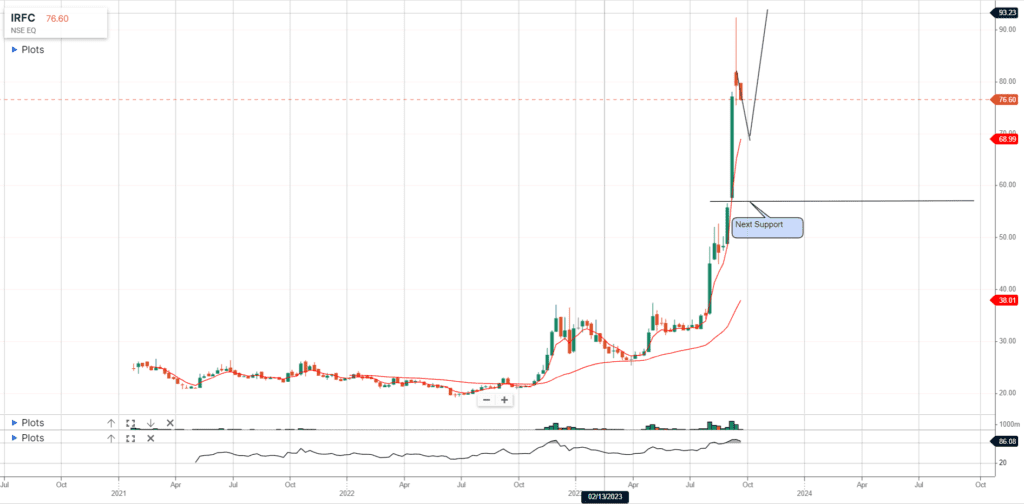

From the debut on the stock market on 20th January 2021 with a price band of ₹25- ₹26, IRFC shares are up about 23% in 2022, and after a decent correction at the end of 2022, share price skyrocketed after April 2023, making nearby 4 times return.

Here is the stock, Indian Railway Finance Corporation Ltd (IRFC). Based on this huge performance, let’s consider the IRFC Share price target 2025. If someone had invested 1 lacks rupees during 2021, he could have got 3.41 lacks by 2023 September 2023, and almost similar amount someone could have gained if he/she had invested by October 2022.

IRFC: What Business it’s doing?

Indian Railway Finance Corporation (IRFC) is a public sector enterprise that provides financial services to the Indian Railways. From various sources like bonds, loans, and leases it raises funds and lends them to the railways for their capital expenditure and operational needs. IRFC runs under the administration of the Ministry of Railways and is considered as one of the largest debt takers in the Indian market. IRFC is now at par with the segment P.E ratio indicating huge growth potential and attractive dividend yield. Let’s dive into the fundamentals and technical of IRFC and predict an IRFC share price target for 2025

Revenues, profits, and assets over the years of IRFC have shown consistent growth. Its ROE (return on equity) was 11.21% in FY 2022, 9.83% higher than the industry average. IRFC Q-1 and Q-2 2023 results were down by 6.3% but the Net Profit margin remains unaltered at approx 97.50%. It indicated a stable profit margin year on year. Its debt-to-equity ratio was 9.67, lower than the industry average of 10.54. Its earnings per share (EPS) was 3.07 rupees in FY 2022, a little up from 2.22 in FY 2021.

IRFC holds a monopoly position in its niche as the lone financier of the railways and has a strong client relationship. It also benefits from the

sovereign guarantee of the government of India, which ensures its creditworthiness and lowers its borrowing costs. In Its business model Indian Govt. pays a high-value fixed margin return against the loans and leases. Exiting the tension of rate of interest and Currency risk, which make it business model low risk. Including these IRFC has diversified its funds to Domestic and Foreign currency bonds, term loans from banks and financial institutions, and lease financing.

Including all these positive factors also some may affect the future performance like if any Govt. regulatory risk and taxation norms, getting payment may delayed or defaults by the railways, the fluctuations in interest rate by govt., like wise inclusion of new players also kind of threat to the monopoly. After all these are manageable, not hamper to the core business and alternate sources.

IRFC share price target 2024

Based on the Fundamentals and Technical analysis of the company, its and recent performance it passes all the tests of a multi-bagger stock. Let’s go to a brief prediction about the IRFC share price target 2024.

The Price target for 2024 for IRFC is Rs 172.5 to Rs 180. First half of the year 2024 stock may go down till Rs 132.95 and consequently, it will bounce back and reach the target of Rs 180.

IRFC share price target 2025

IRFC, from its opening day at the share market, has given a mouth-watering return of almost 4 times within 3 years. Within the last 3 months IRFC stock price surges from ₹33.5 to ₹79.35, more than double. The stock price has soared 27.1% in the last week, while 202.9% in the last 6 months, a spectacular 271.1% return in the last year. So IRFC became the Buzz among the investors after likewise IRCTC stock once had. The question is can the stock price retain the momentum and it could perform in the long run with.

Based on the Fundamentals of the company, its and recent performance it passes all the tests of a multi-bagger stock. Let’s go to a brief prediction about the IRFC share price target for 2025. As it has given a massive return in the last three months, now stock may undergo a selling till the next support line of price point ₹50.5 by the end of December 2023. Till the July of 2024, IRFC’s share price may touch ₹110 again considering as its resistance line, by the time of the 3rd quarter of 2024 it may touch ₹150. After that it may undergo a normal correction till ₹120 thereafter it will skyrocket till ₹200 target price approximate gain of 30% within a quarter. By the end of 2025 stock may get a price correction and go in a sidewise market, but at the end of the year, it may visit north (which means the price will move up). Let’s see the details below…

IRFC Share price Target 2023, 2024 & 2025

| 2023 | 2024 | 2025 | |||

| Prediction | Max Price | Prediction | Max Price | Prediction | Max Price |

| Oct-23 | ₹ 65.00 | Jan-24 | ₹ 97.00 | Jan-25 | ₹ 186.00 |

| Nov-23 | ₹ 78.00 | Mar-24 | ₹ 128.00 | Mar-25 | ₹ 200.00 |

| Dec-23 | ₹ 82.00 | May-24 | ₹ 150.50 | May-25 | ₹ 225.00 |

| Aug-24 | ₹ 128.00 | Aug-25 | ₹ 250.00 | ||

| Dec-24 | ₹ 180.00 | Dec-25 | ₹ 225.00 | ||

IRFC Peer Competitors

Even though there is no such exact peer competition, still some large performers are there which could be the next competitors ahead.

This is Pvt. Sector company that manufactures railway wagons, locomotives, coaches, and other related products. Market capitalization: 3771.8 crores

This is a private sector company that produces forged and machined components for various industries, including railways, automobiles, oil and gas, and mining.

FAQs

Is IRFC good to buy now?

Ans: As it is overpriced now, wait till the price falls to 65-62, then it is perfect to Buy. If you are a long-term investor then you can do it now.

If IRFC will perform like IRCTC in the future?

Ans: Yes IRFC has the potential to outperform IRCTC, although the business model is different, the potential is almost the same.

What business does IRFC do?

Ans: Indian Railway Finance Corporation (IRFC) is a public sector enterprise that provides financial services to the Indian Railways. From various sources like bonds, loans, and leases it raises fund and lends them to the railways for their capital expenditure and operational needs.

N.B: However, investing is subjected to market risk. we are only putting our best effort as a torch bearer in the investment learning world. Before investing you can do your own research, gain knowledge then invest.

Conclusion

IRFC is multi-bagger stock for future investment like IRCTC. It has sole potential to move to greater price point and within coming 5 years it will reach to more than ₹500. If you are wish to get a 8-10 times return in half of a decade, then put some shares in your investment basket.It may touch 500 above price point by 2025 and by 2030, it will touch 4 figure share price mark.

Should you Buy IRFC ?

Yes 85% positive feedback.

3 thoughts on “IRFC Share price Target 2025”

Comments are closed.