Dear Readers, Keeping in mind Technical and fundamental analysis l predict the Idfc first bank share price target 2025, 2023 & decades ahead. Lets deep dive into the topic, at the end you will be able to judge whether stock is investible or not?, what could be the predicted price of IDFC first bank in 2025, 2030 and 2050 etc.

When IDFC First Bank Founded: A Brief About

IDFC First bank, which is a culmination of two major corporates, one is NBFC expert Capital First, other IDFC bank, which has strong authority in both Finance and infrastructure.

Strategically, In January 2018, the IDFC Bank and the Capital First announced a merger. Shareholders of former Capital First were issued 13.9 shares of the merged entity for every 1 share of Capital First. As a result, IDFC FIRST Bank was founded as a new entity on December 18, 2018. In January 2019, the combined entity listed its new shares on the NSE and BSE (IDFCFIRSTB: NSE, 539437: BSE).

The IDFC FIRST Bank adopted the proven model of Capital First, with IDFC Bank’s platform. The bank has outstanding technology stack, distinct digital banking and strong rural outreach. It also used cutting-edge solutions to meet the needs of bigger businesses and corporates. The Bank aimed to create a culture that put customers first, which influenced its product and service development, and customer satisfaction

Current Share Price of IDFC First bank

As of 13th Feb 2024, the share price was Rs 79.25. In the year 2023 Idfc first bank given a great return of 66.12% from its lowest price point (Rs 53.45).

IDFC First Bank Share Price Target

The bank was public from 2015 with share price of Rs-70.30/- after that the share price had only saw a all time high of Rs 83.45 by 2016. Thereafter the share price starts falling the reason may be Demerger from IDFC. But once IDFC First bank become a separate entity it share started moving up, but it was short stand due to COVID-19 pandemic by mid of 2020 time period, share plunged to All time low share price of Rs-17.70/-.

However, aftermath, the bank share never looked back, it fueled up till all time of high price of Rs-100.6/- embarking a three digit share price during the year 2023. Investors those who have had invested during its lower price range, they must have booked a massive return around 468% within only 3 years of journey.Its proven the bank has a strong solid team with tremendous effort given to make the bank move forward with a great vision.

Also Read: Yes bank Share Price Target 2025

IDFC First Bank Share Price Target 2024

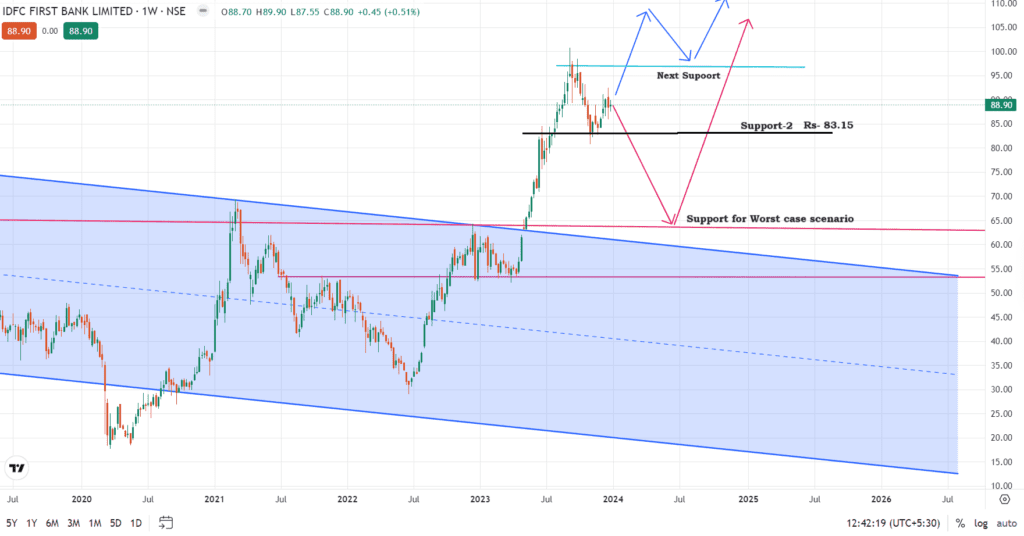

This year’s share price could show only marginal improvement in the price as the year 2023 was bullish for the share. If you look up the figure attached below, you can guess the price action for the Year 2024. The maximum possible share price in 2024 is predicted as Rs 110.85 with an minimum price of Rs 83.15.

During 2024 the share price will give a correction to Rs 83.15 price point which is its minimum support level if any worst case happens like terrible news for the IDFC First Bank or the Economy concern or any negative case then the price could fall to Rs 63.90.

| 2024 | Min Share Price Target (Rs) | Max Share Price Target (Rs) |

| January | 92.24 | 103.2 |

| February | 92.6 | 105.5 |

| March | 83.15 | 97.57 |

| April | 92.85 | 103.64 |

| May | 94.44 | 110.85 |

IDFC First Bank Share Price Target 2025

This year the IDFC First Bank share price will take a bull ride than 2024. The maximum share price target for 2025 will be Rs 149.80 whereas a minimum price could be 117.50. Follow the table for an idea of targeted fluctuations in the price point quarterly.

| 2025 | Min Share Price Target (Rs) | Max Share Price Target (Rs) |

| January | 117.85 | 129.5 |

| April | 118.23 | 130.66 |

| June | 121.52 | 133.84 |

| September | 131.62 | 144.58 |

| December | 137.15 | 149.80 |

Also Read: IRFC Share price target 2025

IDFC First Bank Share price Target 2026

| 2026 | Min Share Price Target (Rs) | Max Share Price Target (Rs) |

| January | 135.1 | 148.62 |

| April | 134.48 | 148.6 |

| June | 138.86 | 154.22 |

| September | 148.73 | 164.84 |

| December | 153.34 | 170.61 |

IDFC First Bank Share Price Target 2027

| 2027 | Min Share Price Target (Rs) | Max Share Price Target (Rs) |

| January | 150.9 | 169.02 |

| April | 151.35 | 169.32 |

| June | 155.49 | 175.72 |

| September | 165.5 | 187.86 |

| December | 170.17 | 193.34 |

Future Plan of IDFC First Bank

IDFC First Bank has a strong position to increase its market share and profitability, taking advantage of various growth opportunities.

In Current Scenario Since its merger four years ago, IDFC FIRST Bank has shifted its focus from infrastructure to retail banking. As of September 30, 2023, its CASA ratio (current account savings account) has risen from 8.7% to 46.4%. Its Total Customer Deposits have grown by four times, from Rs. 39,602 crores at the end of 2018 to Rs. 1,64,726 crores at the end of September 2023. The Bank has also expanded its network to 862 branches and 1,111 ATMs.

First Priority for IDFC First Bank, Retail banking, which is about 65% of its loan portfolio as of June 2023. The bank has a goal of expanding its retail loan portfolio by 25% annually (CAGR) for the next five years, and also aims to grow its branch network to 800 by March 2024, strengthening its presence in the retail banking industry.

Secondly Rural banking Sector, The bank serves over 10 million customers in rural and semi-urban areas through its network of business correspondents. It offers various products designed for rural customers, such as loans for microfinance, agri-business, tractors, and gold, savings accounts, money transfers, and insurance.

IDFC First Bank plans to leverage its rural penetration to sell more products and services and expand its customer base in these regions. Large implementation of digital banking and strict regulations of Banking rules will attract the rural sectors into the mainstream, where the IDFC first bank has a big game remaining.

And third priority will be Corporate Banking: The bank has a varied corporate banking portfolio, comprising infrastructure finance, working capital finance, trade finance, project finance, structured finance, treasury services, and investment banking.

It targets to sectors such as power, renewable energy, telecom, roads, ports, airports, urban infrastructure, and manufacturing, and aims to grow its corporate loan book by 15% CAGR over the next five years. Moreover, IDFC First Bank plans to boost its fee income through advisory, arrangement, and syndication services.

The IDFC First Bank is mostly trying to hold and manage small loans rather than any kind of big loans with Corporations. So, low risk of fraud or money laundering scams in the future. This could be another important factor for the boosting of IDFC First Bank’s share price.

As an Options trader Which mistakes should not be repeated. Just have read Options Trading Strategies: Mistakes to avoid as a Trader

IDFC First Bank Share price Target 2030

Based on the plans of the IDFC first bank, it is well guessed, that the vision of the company is very clear to extend the businesses in rural areas and expand to different sectors. Deep penetration of digital banking by 2030 in rural areas and the rise of ongoing MSME projects will help the bank reach a great share price.

Imagine India already reached 5 Trillion Economy by 2030, then which sector is going play a wholesome game, of course, the Banking sector. Most technology and Artificial intelligence-driven time period will be run by highly tech-savvy banks among them IDFC First bank could be a game changer.

Hence the Idfc first bank share price target is expected to give a return of 331.10%. In the year 2030, the maximum price point would be Rs 292.40, while lowest price point might seen could be 218.75.

| 2030 | Min Share Price Target (Rs) | Max Share Price Target (Rs) |

| January | 218.75 | 227.24 |

| March | 222.54 | 249.12 |

| June | 237.87 | 265.23 |

| September | 272.25 | 292.40 |

| December | 268.63 | 282.56 |

Buy or Sell: Expert’s Opinion about IDFC First Bank Share Price

View 22 reports from 7 analysts offering long term price targets for IDFC First Bank Ltd.. IDFC First Bank Ltd. has an average target of 91.32. The consensus estimate represents an upside of 2.72% from the last price of 88.90. By Trendlyne.com.

Anand Rathi is Bullish on IDFC First Bank. He said” The bank expect to reach 13-15% ROE by FY25 & 1.4-1.6 % ROA by FY25″

ICICI Securities is bullish about IDFC First Bank and set target of Rs 105.

IDFC First Bank Share Price Target for 2035 to 2050

This could be very difficult due to being such futuristic, but if the stock does not undergo any kind of Disputes and uncertain circumstances then the IDFC First bank share price target for 2035 to 2050 will be realistic like below.

| 2035-2050 | Min Share Price Target (Rs) | Max Share Price Target (Rs) | Average Percentage of Return Comparing from Today (Rs:89/-) |

| 2035 | 432 | 512 | 524.4% |

| 2038 | 689 | 784 | 818.3% |

| 2040 | 945 | 1025 | 1094.4% |

| 2043 | 1120 | 1350 | 1372.0% |

| 2045 | 1554 | 1650 | 1780.0% |

| 2050 | 2020 | 2250 | 2342.0% |

Shareholding Pattern of IDFC First Bank

| Stake Holders & Quarter Results | Q-1 | Q-2 | Q-3 | Q-4 | Q-1 | Q-2 | Q-3 | Q-4 | Q-1 | Q-2 | Q-3 |

| PROMOTERS | 39.98% | 36.56% | 36.52% | 36.51% | 36.49% | 36.48% | 36.47% | 36.38% | 39.99% | 39.93% | 39.37% |

| FII | 11.88% | 15.09% | 14.76% | 14.77% | 13.48% | 10.99% | 19.28% | 19.76% | 19.31% | 20.85% | 24.48% |

| DII | 11.23% | 11.93% | 10.18% | 10.37% | 9.58% | 10.19% | 9.83% | 9.61% | 7.69% | 7.71% | 5.58% |

| GOVT. | 4.61% | 4.21% | 4.21% | 4.21% | 4.20% | 4.20% | 4.23% | 4.22% | 3.98% | 3.97% | 3.92% |

| PUBLIC | 32.31% | 32.21% | 34.33% | 34.15% | 36.24% | 38.14% | 30.18% | 30.02% | 29.05% | 27.54% | 26.66% |

The Share continuous upholding of Foreign Institutional Investors (FIIs) gives good signals for long run of the share price. But the series decrease of shares from Domestic Institutional Investors and Public could be a concern of stabilty.

Dear Investors lets have read of Top-5 Mutual Funds that gives 30% return yearly

SWOT Analysis of IDFC First Bank Share price

STRENGTH

The Company with high TTM EPS (Trailing 12 months earnings per Share) Growth which indicates the rate of profitability growing fast.

It also has strong quarterly & Annual EPS growth.

Consistent Revenue growth from last 4 quarters.

Last 2 years Book value per share also getting better.

Company has No Promoter Pledge

Shareholding of FIIs is increasing gradually.

WEAKNESS

Not Giving Dividends

High Interest Payments compared to earnings, which is a bad signal for the Company, which to be improved ahead by the company to compete with its peers.

More amount of Contingent liabilities (Rs 3,63,404 Cr.) (Source: Screener.in)

Company not able to generate net cash flow

OPPORTUNITIES

Broker firms increase the target price of the Stock

RSI has a good positive strength.

Company’s Insiders are buying stocks.

(Source: Moneycontrol.com)

THREATS

No Such Threats are visible for the stocks.

Conclusion

It’s a completely personal opinion, based on facts and past performances, IDFC first bank passes almost all the tests to become a bullish stock. An expectation of 300-350% or more return by 2030, and even if you stay invested for more years, more compounding is obvious. The management has an aggressive approach towards the growth with such intention, that the share price is ultimately going to grow.

N.B: However, investing is subjected to market risk. we are only putting our best effort as a torch bearer in the investment learning world. Before investing you can do your own research, gain knowledge then invest.

Frequently Asked Questions (FAQs)

Who is the CEO of IDFC

V. Vaidyanathan serves as the Managing Director and Chief Executive Officer of IDFC First Bank, from 19 Dec 2018.

How many branches of IDFC first bank exist in India?

IDFC First Bank has 824 branches and 1,069 ATMs in India

Which are the peer competitor of IDFC First Bank?

HDFC Bank, ICICI Bank, Kotak Mahindra Bank, Axis bank and Indusind Bank, IDBI bank and Yes bank etc.

1 thought on “Idfc First Bank Share Price Target 2025”

Comments are closed.