Ideaforge Share Price

Ideaforge Share: Is it worth Buying?

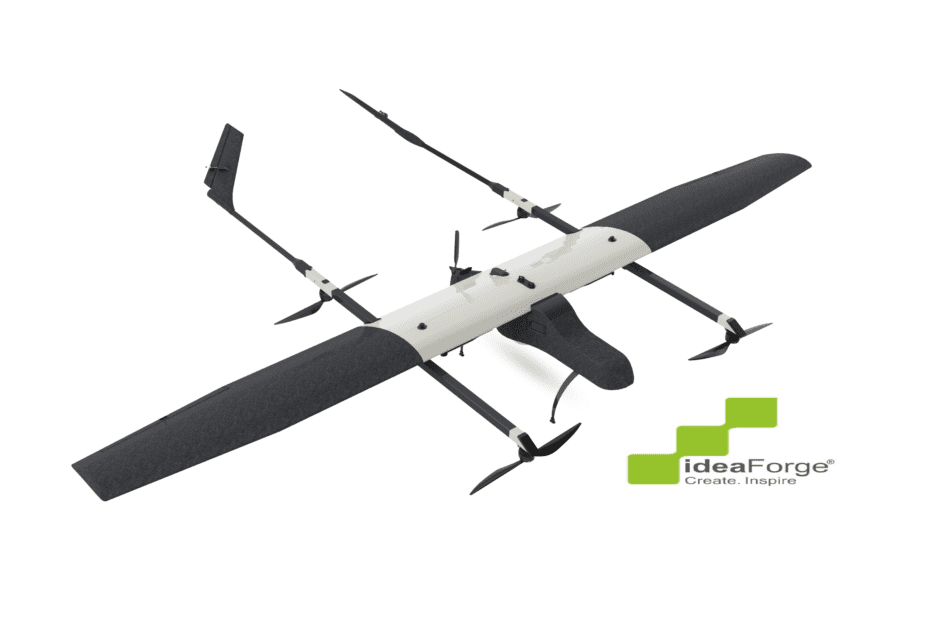

IdeaForge Technology Limited Manufactures Unmanned Aircraft Systems (UAS) for Mapping, Security & Surveillance. These drones are capable of a wide range of mining area planning and mapping applications. IdeaForge UAVs help construction and real estate boost their operations. They also assist defense forces in conducting Intelligence, Surveillance, and Reconnaissance (ISR) operations along the border.

Ideaforge is going public on Friday, It is an Indian drone manufacturer that

recently went public. The company’s shares are expected to list at a premium of

75-80% on the exchanges on Friday after commanding a grey market premium of Rs

515 in the unlisted market. Despite of higher price range still, it’s expected to give a bouncy return to the

investors. The price per share has gone around 637-672, which may also go even higher on opening day as the demand persists for giant drone companies.

Ideaforge lot size of IPO

| Application | Shares | Lots | Amount |

| Retail (Max) | 286 | 13 | ₹192,192 |

| Retail (Min) | 22 | 1 | ₹14,784 |

| S-HNI (Max) | 1,474 | 67 | ₹990,528 |

| S-HNI (Min) | 308 | 14 | ₹206,976 |

| B-HNI (Min) | 1,496 | 68 | ₹1,005,312 |

Brief idea About Ideaforge Technology Limited:

IdeaForge Technology Limited Manufactures Unmanned Aircraft

Systems (UAS) for Mapping, Security & Surveillance. These drones are

capable of a wide range of mining area planning and mapping applications. IdeaForge

UAVs help construction and real estate boost their operations. They

also assist defense forces in conducting Intelligence, Surveillance, and Reconnaissance

(ISR) operations along the border. The company is the market leader in UAS segments in India and 7th largest in the world.

IdeaForge share Price target for 2024 & 2025

Based on aggressive demand Ideaforge share price almost doubled in the opening day. After 2 days of gap, investors started booking the profits and share value started going down. But every stock undergoes a Roller-coaster journey to remain on standby. Based on the recent scenario of Technical Analysis stock will come to its next support level which is around Rs-1110/- and if again comes down it will go up to its ask bid price which is Rs-670/-.But, before jumping into running water, just calm down, Ideaforge is overbought as compared to P/E value (125) which is more than double that of its peer competitors.

Ideaforge share price jumped around 95% on grand opening day, so it may go through a steady downtrend to make it ready for the next big jump. Of course, new stock creates a wave in the market just like what happened to Nykaa, Zomato, Paytm, and others trending now. Just dive into the chart of these stocks and analyze them, and you will find a quite similar pattern. After the grand opening jump, they started falling and now they were ready to jump, and just now the buzz of the town. It’s a golden pattern in the share market but this pattern is only respected by strong fundamental companies.

But, whether you should invest in Ideaforge share or not?

Look, This is complete your call! What could be a win-win situation is, just wait for the next big buying with an appreciable buying so that you will get a confirmation to take it into your Investing basket. Let’s come to a price of 1100 or the next bottom line is 850 & 720, then with great price take an entry for long term.

The way Ideaforge share price heightens in the market its shows the days ahead of the journey. Our target for next year 2024 is Rs-1250/- to 1350/-.

Similarly, it may stay calm in 2024 and may jump to another height up to Rs-1500/- 1600/-price band, which may be considered a target for 2025.

We value your hard-earned money so before investing you should consult or gain knowledge and keep updated about your investments.

Great luck and Wealth.

As an Investor choosing the right profitable stock is a task that we are solving for you, you can read our Blog for latest share price targets.

Visit https://stockmarketviews.in