Alphalogic Industries ltd share price is not open now on NSE/BSE, but its starting bidding price was 96/- per share with an aggregate of 12.88 crores. Minimum order value is 1200 shares which cost 1,15,200 rupees. It has total 13,41,600 equities with a face value of 10 rupees. Out of total shares 1,33,200 shares are reserved for company promoters, 11,41,2000 shares for public and rest 67,000 for market makers.

Alphalogic Industries ltd share price: Lets know About the Company

Alphalogic Industries Limited was founded in the year 2020 by experienced professionals from the Storage System industry. They are designing storage solutions which leave more space at your workplace for productive pursuits.

Their state-of-the-art manufacturing facility located in Pune, Maharashtra delivers an array of customized storage systems that are safe, easy to use, save space, and look beautiful owing to the perfect finish with the best quality. Alphalogic Industries ltd understand the industry needs and study the usage-specific requirements to suggest designs that fulfill the storage requirements in the best possible manner. They are also rated amongst the best Storage system manufacturers in Pune.

The vision of the Company “To be a globally recognised leader of innovative, high-quality industrial storage and racking systems that help their customers to improve the efficiency, productivity, sustainability, and create a positive impact on society.

Alphalogic Industries ltd share price: SWOT Analysis

Strengths:

- Strong Annual Earning Per Sharing Growth

- Annual Net Profits improving for last 2 years

- Book Value per share Improving for last 2 years

- Company with Zero Promoter Pledge

- Stock gained more than 20% in one month

Weakness:

- Inefficient use of capital to generate profits – Return on Capital Employed declining in the last 2 years

- Declining Net Cash Flow: Aplhalogic is not able to generate net cash

Opportunity:

Threats: Till now technically no threats to consider.

Alphalogic Industries ltd share price target 2023

Alphalogic Industries have skyrocketed to north with massive 240% growth till the first week of October. But the stock has given a correction from last two weeks which may be going touch the next Support of Rs 300.42 in Daily time frame. If the price break down then next support will be the Rs-249 which is a strong support in weekly time frame also. However from the Price point of 249, share price may spend some time and then bunce back to a next resistance (Its previous support Rs-300.42). So in this year 2023 it has already given huge up move, now at the end of last quarter it is time for giving correction till 249 price point.

Alphalogic Industries ltd share price target 2024

After a correction during Last quarter of 2023, in 2024 first quarter it may again rise to its nearest resistance of 340.42 and by the middle 2024, it may again rise to 410 or more.

Alphalogic Industries ltd share price target 2025

The target price may take side wise pattern till 2026, so that the pattern may help of the get a upside move during 2026. In 2025 price may vary from 285 to 340 per share.

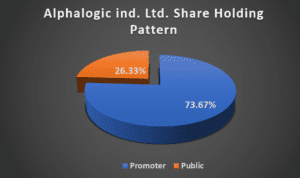

Alphalogic Industries ltd share Holding Pattern

Alphalogic industries Ltd share holding of Promoter 73.67% and of Public sharing is 26.33% .

Alphalogic industries Ltd. (AlphaInd) Peer Competition

| Company Name | Price | MCap(Cr) | TTM PE | P/B | ROE(%) | Net Profit(Rs.) | Net Sales(Rs.) | Debt to Equity |

| Alphalogic Ind | 324.4 | 165.27 | – | 18.12 | 20.35 | 132 | 10,739 | 0.72 |

| Five-Star Busin | 733.05 | 21,420.56 | 33.06 | 4.94 | 13.9 | 603 | 1,520 | 0.98 |

| Nexus Select | 127.22 | 19,273.83 | – | 1.27 | 0 | -2 | 0 | 0 |

| Kaynes Tech | 2,341.10 | 13,611.74 | 131.52 | 14.2 | 9.88 | 94 | 1,086 | 0.13 |

| Syrma SGS | 612.7 | 10,831.18 | 173.08 | 7.48 | 3.78 | 55 | 1,135 | 0.17 |

Conclusion: Is it Worth Buying now?

As the share as given already a 240% growth from its inception, its overvalued. The stock grow up to 300% or more by the time, but after that it may undergo an correction till Rs- 240-245 for some months or year. Ether buy now and ride a bull run till 400 or 425 price point or else wait till for good correction. Choice is yours.

N.B: However, investing is subjected to market risk. we are only putting our best effort as a torch bearer in the investment learning world. Before investing you can do your own research, gain knowledge then invest.

Also Read: Adani Power Share Price target for 2024