Before predicting Adani Enterprises share price target 2025, let’s take a short deep dive into the Company. Adani Enterprises is one of the largest conglomerates of the Adani Group with a capitalization of ₹3.72 Trillion INR ($45.04 Billion) as of February 2024.

About Adani Enterprises

Adani Enterprises has been there since the Company’s listing in 1994, it has multifold value for stakeholders while contributing to nation-building. Adani Enterprises Limited (AEL) at present focuses on businesses related to airports, roads, solar manufacturing, water management, defense and aerospace, data centers, edible oils and foods, mining, integrated resource solutions, and integrated agri products. It’s a large-cap company that extraordinarily gained market capitalization from $8.42 Billion to $45.04 Billion within the last 10 years. The share price value also increased from Rs 90.84 to Rs 3273.30 from the last decade, February 2014 to February 2024.

Adani Enterprises share price History

Adani Enterprises Limited (AEL) was first listed on the Bombay Stock Exchange(BSE) on November 25, 1994, and on the National Stock Exchange (NSE) on June 4, 1997. AEL is part of the Adani Group, one of India’s leading business houses.

On September 12, 1994, Adani Enterprises had an Initial Public Offering (IPO) of 1,261,900 shares of Rs 10 par value at a premium of Rs 140 per share. Thereafter only once the share had a split in 2004 with the face value of its shares from Rs 10 to Rs 1. From July 28, 2004 onwards the share has been quoted on an ex-split basis.

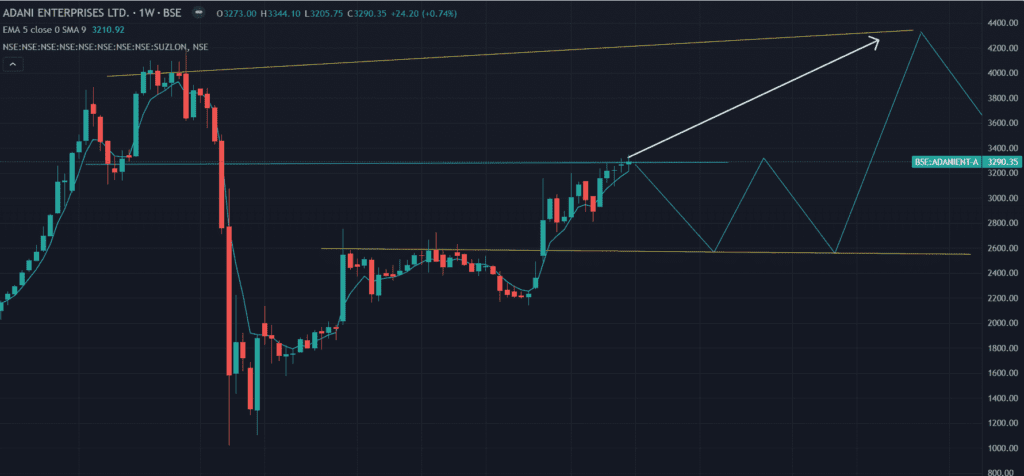

The current share price of ADANIENT is Rs 3317.80 as of March 2nd, 2024, this is its 52 week high price.

Adani Enterprises Share Price Target 2024

The Company has a recent Share price of 3273.30 by 24th February 2024. The share price target for Adani Enterprises is Rs 4303. This year share price may vary from a lower price of Rs 2565 to Rs 4303, which means this year price will be very volatile and finally reach the target by the last quarter of 2024.

Adani Enterprises Share Price Target 2025

Adani Enterprises share price target for 2025 is Rs 5220 around a 21% upside from 2024.

Investors can also go through: Tata Elxsi share price prediction 2025

Adani Enterprises Share Price Target 2026

The share price of Adanient may rise up to 6200 by the year 2026. The minimum price expected is Rs 5600 and the maximum is Rs 6200.

Adani Enterprises Share Price Target 2030

Looking into the current growth scenario and the multiple construction, energy, and defense projects taken by the Adani group will mostly be completed by 2030 and they could have started giving profits from current investments. So, considering the company’s excellent existing opportunities, Adanient share price target 2030 is expected to cross Rs 10,000. The minimum share price could be Rs 9752 to a maximum Rs 10200 subject to the condition the stock price should not split.

Adani Enterprises Share Price Target 2035

Imagining from today towards 10 years ahead is no doubt very difficult. But based on Adani’s prior history and the business milestones created it is very clear that Adani Enterprise is a very adaptive & future-ready company. Projecting ADANIENT share price for 2035 will be Rs 21000, with the minimum expectation is Rs 19500. If the stock splitting happens also within 2035, the share price may change but the share will give a decent return to its investors.

Information Add-ons about Adani Enterprises

Shareholding Pattern of Adani Enterprises (ADANIENT)

| Mar-21 | Jun-21 | Sep-21 | Dec-21 | Mar-22 | Jun-22 | Sep-22 | Dec-22 | Mar-23 | Jun-23 | Sep-23 | Dec-23 | |

| Promoters | 74.92% | 74.92% | 74.92% | 74.92% | 74.92% | 72.28% | 72.62% | 72.62% | 69.23% | 67.65% | 72.61% | 72.61% |

| FIIs | 20.51% | 19.65% | 18.05% | 17.25% | 16.62% | 15.83% | 15.59% | 15.39% | 17.75% | 19.34% | 14.52% | 14.65% |

| DIIs | 0.83% | 2.14% | 3.87% | 4.96% | 5.69% | 5.68% | 5.33% | 5.45% | 5.15% | 5.46% | 5.65% | 5.44% |

| Public | 3.74% | 3.29% | 3.16% | 2.87% | 2.77% | 6.22% | 6.46% | 6.53% | 7.87% | 7.54% | 7.23% | 7.30% |

| No. of Shareholders | 1,48,923 | 2,22,685 | 2,14,588 | 2,45,611 | 2,26,071 | 2,34,308 | 2,63,609 | 2,53,432 | 7,46,605 | 6,61,255 | 5,66,232 | 5,61,309 |

Analyze another stock for investment from Adani Group: Adani Power share price target 2025

Adani Enterprises Dividend Yield History

The company has a good track record of providing regular dividends to investors at an average of 92% (Rs 0.92) per share over the last 5 years.

| Declare Date | Ex-Date | Dividend Type | Dividend (%) | Dividend (Rs) per each share |

| 04-05-2023 | 07-07-2023 | Final | 120 | 1.2 |

| 04-05-2022 | 14-07-2022 | Final | 100 | 1 |

| 05-05-2021 | 01-07-2021 | Final | 100 | 1 |

| 12-03-2020 | 23-03-2020 | Interim | 100 | 1 |

| 29-05-2019 | 29-07-2019 | Final | 40 | 0.4 |

| 10-05-2018 | 27-07-2018 | Final | 40 | 0.4 |

Expert’s Opinion About Adani Enterprises share price target!

Adani is ‘too big to ignore’ says Cantor Fitzgerald; sees 50% upside for Adani Enterprises, By Live Mint

Adani Enterprise, Adani Ports and Adani Power are the three top bets among Adani stocks. We generally have a pre-election rally of around 10% to 15%. By Economictimes

Conclusion: Should You Invest in Adani Enterprises (ADANIENT)?

Based on the current scenario, Adanient is overpriced, but after a value little correction like from Rs 3000,its a good buy call. For the long term, it could be a safe egg in your basket. Due to political stability, doing ease of business, the Stock is waiting for long bull run.

PROS

- The company has delivered good profit growth of 27.3% CAGR over the last 5 years

- Debtor days have improved from 72.1 to 33.4 days.

CONS

- Stock is trading at 10.0 times its book value

- The company has a low return on equity of 7.01% over the last 3 years.

FAQ

What is the market capital of Adanient?

The market capital of Adanient is 3.78 trillion INR, it’s a large-cap Equity stock.

Why Adani shares are increasing now?

After Steef correction, normally price increases, and in addition, a stable govt is also a good sign of ease of doing business.