Suzlon share price target 2025 may cross Rs 50. The demand for Renewable energy is increasing exponentially with the steady growth of population and energy requirements. As India is a peninsula (a landmass surrounded by water on three sides and land on one side), the coastal area covers the average area, and harvesting wind energy could be a main renewable energy source.

About Suzlon

A brief about Suzlon, it is among the top renewable energy generating companies that mastered wind energy harvesting. Suzlon is a global leader in renewable energy solutions, with operations in 17 countries across Asia, Europe, Africa, and the Americas. With its advanced R&D and over 20 years of experience, Suzlon offers a wide variety of high-quality and dependable products that deliver optimal performance, higher returns, and lower environmental impact for its customers.

Suzlon’s products are backed by its eight R&D facilities in Germany, India, Denmark, and the Netherlands. It is one of the world’s leading Wind turbine generators (WTGs) producers. Since its starting, it has established over 12,780 wind turbines across six continents and 14 world-class manufacturing units in India. The company also provides operations and maintenance services (OMS) of its company WTGs as well as takes OMS contracts of multiple brands. It also has a branch working with OMS on commissioned solar energy projects.

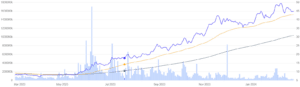

Suzlon’s Current Share Price

As of 4th January 2024, the share price of Suzlon was Rs 38.70. The tremendous growth of Suzlon share price in 2023, almost 350% of ROI, from a share price of Rs 10.68 to Rs 38.62.

Why was Suzlon’s share price surged in 2023?

Multiple reasons were there, but the major cause was Debt Reconciliation, Suzlon had cleared almost all its debts within a year and became a debt-free company. Along with that, the company has acquired some new projects in its hands. It has installed the largest windmill in India and Govt. of India is also focusing & planning on harvesting renewable energy.

The market cap of Suzlon is around Rs 59246 Cr, whereas the profit is 600 crores. The EPS, earning per Share is Rs 0.45/- which needs improvement for a good amount of rally in the share price. The P.E ratio is also 160 which is very high, if Suzlon shows a positive growth rate year by year, then the share price of Suzlon will increase, and based on this we can set Suzlon share price target 2025.

Suzlon share price target 2024

Based on the Balance Sheet, Suzlon is an almost debt-free company with a lower earning ratio. But with the company’s plan and more strategic moves from the last couple of years, the intent of management is looking forward to a better future. After a high peak of share price in 2023, this year in 2024 share price may remain stagnant within a price range. My analysis of Suzlon’s target share price for 2024 will be Rs 58 by 2024 and if it goes low then the price may reach Rs 39.

Suzlon share price target 2025

Suzlon share price target 2025 may cross Rs 65 which is almost 64% upside from today’s price point. The share may give form Breakout chart pattern from its price range made in 2024 which ranged between Rs 39 to Rs 58.

Suzlon share price target 2026

The energy company may get a bunch of new projects from Govt of India’s Renewable source energy production program. This will boost revenue and profitability and propel the stock price to a 10-year high. So, Suzlon’s share price target for 2026 may be Rs 102 with a minimum expectation of 84.

Suzlon share price Target 2030

By the time 2030 Suzlon’s share price can cross Rs 200 which is the next resistance in the candle stick pattern as well the potential of the company is also looking good enough to grow the share price to Rs 200 point.

Future Plan of Suzlon Energy Solution

Suzlon’s new Management to clear the maximum debts from the company and focus on acquiring more renewable energy Govt. projects. The government of India is likely to focus more on harvesting Wind and solar energy in the next 5 to 10 years. In this context, Suzlon may be a great contestant.

From December 2023 to February 2024, Suzlon has received 7 deals of around 1564.8 MW energy production as mentioned in Suzlon’s Media room.

Shareholding pattern of Suzlon

| Dec-20 | Mar-21 | Jun-21 | Sep-21 | Dec-21 | Mar-22 | Jun-22 | Sep-22 | Dec-22 | Mar-23 | Jun-23 | Sep-23 | |

| Promoters | 17.46% | 17.17% | 16.52% | 16.41% | 16.04% | 15.85% | 14.92% | 14.50% | 14.50% | 14.50% | 14.50% | 13.28% |

| FIIs | 3.10% | 4.22% | 4.08% | 4.10% | 4.85% | 5.52% | 6.29% | 7.84% | 7.65% | 7.64% | 7.79% | 10.88% |

| DIIs | 17.23% | 16.54% | 17.72% | 17.06% | 14.62% | 13.57% | 15.50% | 8.24% | 5.82% | 5.55% | 5.90% | 9.81% |

| Public | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.02% | 0.02% |

| No of Shareholders | 62.21% | 62.07% | 61.69% | 62.43% | 64.49% | 65.06% | 63.29% | 69.40% | 72.02% | 72.30% | 71.78% | 65.99% |

From the above data, it’s clear the promoter’s holding is too low only 13.3%, which may be a point of concern.

Suzlon Share Price Target 2040

Suzlon share price target 2040 may cross Rs 1000. The demand for Renewable energy is increasing exponentially with the steady growth of population and energy requirements. By the time 2040 we can’t even imagine about bad could be the Air quality index, to fix that lot of Green Revolution may be carried out for renewable energy sources. In this sector, Suzlon has its expertise, which can help it to dominate the renewable energy sector. Thus share price target of Suzlon in 2040 is cross Rs 1000.

Suzlon share price target 2024,2025,2030,2035,2040

| SUZLON’S TARGET PRICE | ||

| YEAR | MIN (Rs) | MAX (Rs) |

| 2024 | 39 | 55 |

| 2025 | 54 | 65 |

| 2026 | 73.4 | 95.8 |

| 2027 | 84.6 | 102.5 |

| 2028 | 118 | 132 |

| 2029 | 138 | 167 |

| 2030 | 165 | 182 |

| 2035 | 322.5 | 380.7 |

| 2040 | 895 | 1007.1 |

Conclusion: Should you invest in Suzlon?

The company’s recent revival policy towards a debt-free balance sheet, rigorous activity towards getting deals, and the World’s Renewable energy source dependency make it a stronger investable candidate in the share market.

One can invest there some percent of the portfolio in Suzlon’s shares, but when you buy it, it’s an independent decision. The first quarter share price may take a dip, but in the long run, it looks good journey. With the flow of a green revolution, green company has a bullish future. Keep updated about the stakeholding of Promoters, if it increases year on year, then you can trust them for long-term investment. Or else We are Here to update you at regular intervals.

Just like Suzlon consider another banking stock IDFC First Bank which is very capable of making your investment multifold.

If you are looking for Blockbuster stock to make your Investment multiplied then you visit our blog at stockmarketviews.in

Frequently Asked Questions(FAQ)

Why is Suzlon’s share price increasing?

The major cause was Debt Reconciliation, Suzlon had cleared almost all its debts within a year and became a debt-free company. Along with that, it has acquired continuously a bunch of new projects.

Who are the peer competitors of Suzlon?

Siemens, ABB, BHEL, CG Power & Industry Hitachi Energy etc are the peers to Suzlon.

Is Suzlon a debt-free company?

Yes, almost debt-free.